Middle-class buyers are increasingly springing for homes they can barely afford

One in 4 middle-income new homeowners — twice as many as a decade before — are buying into cost-burdened situations.

The share of middle-class Americans who are buying wallet-squeezing homes has more than doubled in the previous 10 years.

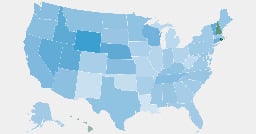

Almost 30% of middle-class homeowners bought homes with monthly payments costing more than 30% of their income in 2022, an NBC News analysis of Census Bureau data found. That’s more than twice the share from 2013, with experts warning it leaves many households with less money for groceries and emergencies and less able to get ahead in the future.

That “cost-burdened” benchmark — in which a household devotes over 30% of income to housing costs — is a widely used measure of affordability for both homeownership and renting. The Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

I’m in the US. House values in my neighborhood have doubled since 2017 (7 years). Things are the same where the rest of my family lives, 11 states away. Are we not in a boom?

The Economy is not booming, it's only the prices of Assets such as houses that are in a bubble.

Last time around the "wealth" (even if illusory) was spreading a lot more and causing all sorts of things to grow by feeding consumption, as well as a general feeling of prosperity (until it turned out it was illusory and the whole castle of cards fell) whilst this time around it's pretty much only large asset owners who are actually gaining from this whilst the rest just increasingly feel poorer and more treading water ever harder merelly not to drown.

It's a different Economic climate and even a different feeling for most people, even if both periods share the house price bubble.

PS: And, by the way, this is not just in the US.

No this is another housing bubble, similar to what happened back in 2010. My house is now worth more than double what I paid for it, which is more than it was at the peak of the housing bubble right before it crashed back in 2010.

But biggest difference this time around is the bubble has been intentionally accelerated by a handful of investment firms that have been buying up all the houses across the US for the past decade.