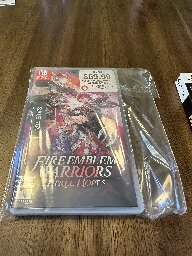

GameStop’s definition of “New”

Literally a used Switch game in a big, ridiculous bag with a “New” sticker on it. Imagine going into a GameStop with a game in a bag like this and convincing them to give you credit for it as “New”.

Don’t buy online from GameStop. Actually, just don’t buy from GameStop.

You are viewing a single comment

And this is the company wallstreetbets wanted so bad to defend. It should have died. It DESERVED to die but Reddit wanted it alive because if there's anything Reddit hates more, it is short sellers. But the reality is that most of the time the companies that get taken down by short selling aren't healthy to begin with. After all, why push a strong company off the cliff when you can push a weak one that is overvalued?

It's not that they wanted GameStop to win. They wanted Wall Street to lose.

I think you are right, at the start they had noble intentions hidden behind a get rich quick scheme.

But then they all became GME holders, they had a vested interest. So now they act like the shitty video game store in the mall is actually cool and innovative and soon some management changes and NFT nonsense will turn the company around.

In some small way, they became what they sought to destroy.

Outside of people clearly being facetious on WSB, I literally never see anybody genuinely have this attitude toward GameStop.

If every pro-GameStop post on r/WSB and r/Superstonk was actually a joke then they have achieved levels of sarcasm far beyond what I thought possible.

What starts out as a joke turns real as people who don't understand it's a joke join in.

The act is very important in the event of an SEC investigation. Since I don’t hold stock in the company, I’m safe to say this, but basically if they wrote “Yeah, I don’t have any faith in the company itself, I just caught Wall Street tycoons making an insane short sell” then that comment could become a major exhibit in an exchange fraud case that makes them forfeit their shares.

I think there was more to it than that. It seemed more like a situation where they could kill two birds with one stone. They could destroy, or at least severely damage the stock market by ensuring the hedgefunds couldn't buy back the shorted stock, and even if they didn't, they had the chance to become extremely wealthy while trying.

It probably would have worked too if it weren't for

those meddling kidsstock brokers like Robin Hood working with hedgefunds to claw back stocks and the SEC towering over them with potential charges of market manipulation.Destroy or severely damage the stock market? It was just one stock, some people lost money but it didn't affect 99%+ of the stock market or its traders.... Just a little meme blip on the scale of things.

It never would have worked. The absolute best case scenario was one hedgefund company has less profit that year.

Watching that all was a bit like watching a sped up version of the crypto boom.

It started off with a bunch of well-meaning weirdos that were sticking it to the man. Then a few people made a whole bunch of money and from there it got super popular and turned into a weird libertarian cult.

It got me interested in stocks. I blew a few bucks on their wacky schemes, but for the most part I put in some long term investments that are slowly climbing.

If you guys haven't done it, Dan Olson released a video talking about it. https://youtu.be/5pYeoZaoWrA?si=fJrgiv3c5OKPpa1c