"Earlier this week, Reddit disclosed in a corporate filing that CEO Steve Hoffman sold 500,000 shares, and Reddit COO Jennifer Wong also disclosed that she sold 514,000 shares."

If they believed in the platform, they would hold. Yeah looks like they are looking for bag holders.

I think it matters more what percent of their holdings they sell rather than the amount they sell.

The COO holds 1.4 million now, so she dumped 25% of her shares

To be fair (and you can probably see by my username I don’t like reddit anymore), I think it makes perfect sense to dispose of a fair portion of your shares in this situation.

Firstly, these asshats get paid part of their salary in shares, it’s natural to want to get more security on part of your income. Secondly, with how hard the price rose in the first couple of days, it makes sense. But people are welcome to disagree, of course.

How does that respond to the original idea, that is:

if they believed in the company, they would hold their stock.

You are not a genius for selling your company's stock after IPO, you are a grifter. Doesn't matter how many voting shares they have, doesn't matter how much more money they need - they do get paid in cash too, and they can borrow against the stock.

So they sold out. Fuck them both for that.

if they believed in the company, they would hold their stock.

The COO holds 1.4 million now, so she dumped 25% of her shares

Selling quarter of your stock AT THE FUCKING IPO is a shame. I can't believe people are defending that.

And I suspect they can't sell the rest as easily as the A shares.

That's SOP for tech companies.

And how does that go against the "they don't have faith in their business" argument?

Imagine talking about faith in that situation. If you really think faith is a good base for financial decisions you better keep far away from the stock market.

I have nothing I'm willing to defend about Reddit management, I love the idea that they will end up penniless one day (though I'm sure that will not happen.)

I just don't think selling off 25% of one's shares (necessarily) means what has been suggested.

What would you agree means that they don't have faith in their business?

Selling everything = I have no faith

Keeping everything when these shares represent almost your entire net worth = I know with 100% certainty that this business will grow

Selling off 25% = I believe in the company, but I also acknowledge that there are many variables outside of my control that can affect the success of this company and I don't want those to have huge negative repercussions on my life.

The point would be to diversify assets. You don't want to gamble everything on the hope the thing you believe in is successful. Not that I think they believe in the platform, but it is probably a smart idea to diversify no matter what. 25% of your shares does seem like a lot though.

If they sold at $50 a share, they pocketed over $25M each. Even after taxes, that is more than enough to live comfortably in any region's cost of living.

That's not diversifying. That is greed.

Them not selling isn't any more greedy. No matter what, they own the value of the stocks, whether they liquidate them or not. It's fucked up that anyone gets paid that amount in general, but they did and it's theirs. I don't know what you people would want from them. Isn't holding onto the shares hoping the value goes up even more greedy?

They get paid in cash ffs.

You sell stock when you think it's overvalued.

Or you sell stock when you need to rebalance. Fuck spez, but selling 25% at IPO seems sane and reasonable to me.

I don't know how much of a bag holding exercise it is instead of a "treat yoself" moment. Half a million shares at $50/share is $25 mil, minus 50% taxes is $12.5 mil.

That isn't that much money in the bay area. Don't get me wrong. It's a lot. But that's just a $4 million house with another $1 million in furnishings, and I'm guessing a nice car or two. Take the other $6 mil and invest in a diverse portfolio. They've basically sold their stock so they can square away their personal lives.

Won't somebody think of the poor shareholders.

When I treat myself, it's to a takeaway meal that's like $20. Reddit has "never made a profit"™. Siphoning $16mil out of it on day one is obscene.

In what way do you think they've siphoned $16mm out of Reddit?

Awarded themselves shitloads of stock, then sold a quarter of their shares each as soon as humanly possible. That money is not being invested in the company, it's going straight in these individual's pockets.

I wasn't trying to make a "won't someone think about the shareholders" argument. Thanks for the strawman.

Really the gist of what I was after is "you'd do the same in their position". $12.5 mil is a lot, but we're not talking about $12.5mil/year. Its a one time sale. Someone that earns $100,000/yr just saw 125 years of income materialize in a couple seconds. But if you had the same opportunity, you'd probably do the same. If you would instead donate it to charity, please let us know which charities you'd donate to.

Fair enough, you didn't say you condone it. But your comment does read with much more support than I would offer. And asking me which charities I'd donate to... ha! I don't see why that's relevant. Maybe I would do the same, but I don't already have an $800,000/yr base salary.

More relevant: this windfall would be 250yrs income for me. And on that income I already do donate to charity (albeit probably about 2% of my earnings). If this chump followed my percentage they would be donating 6 whole years worth of my salary on this windfall (plus 1/3 of my salary per year).

The point is "treating yoself" to $12mil after tax is absolutely obscene whatever way you look at it. Not to mention still sitting on 3x more than that.

That's not how stocks work. Share value doesn't go to the company unless the company sells shares of itself that it owns. It also doesn't lose money from share value unless it buys shares. The value of shares goes to the shareholder when sold, and it comes out of the wallet of the buyer.

It's a show of a lack of faith maybe, but it doesn't effect the company at all except for the effect on stock value from selling if the company also decides to liquidate shares too.

Share prices don't only fall if the company liquidated stock. They will also fall from something like a mass sell-off because lower and lower prices will be commanded to sell large volumes of stock.

You know, like the one in the article that talks about the 25% drop in share value.

Yeah, I mentioned selling dropping the price, but the price doesn't effect the company except for the stocks the company itself sells. Having an extremely high or low stock value doesn't matter if the company isn't selling stocks. It's only an indication that the company is doing well or poorly.

We all knew this was a pump and dump scheme. Spez got his, fuck everyone else.

did he really though? because I'd read a big chunk of that massive 100+ million dollar compensation was shares vested after IPO based on performance.

hopefully it ruins them all.

He sold 500 000 shares for a big fat paycheck. It's not 100 millions of fictional dollars, but he still made out like a bandit.

I'm not so sure. That is only $25 million or so. Who can live on that?

Yeah, this guy isn't even going to be able to afford caviar for dinner every night. That's not living.

$25 million will allow you to, at best, snort cocaine off a hooker’s forearm. Not doing it off her ass is like seeing a partial eclipse.

Me. I can live on that. I would have to change my habits like eating more but that’s something I am willing to change.

Lobster and sushi only on days that end with a Y. It'll be tough cutting back but he'll manage.

I bet i could live even off 24 Million, call me crazy

I'd have to live like a hobo tho

I could live comfortably for the rest of my life on 1/25th of that.

Or you could buy a house within a reasonable distance of a major city.

The statement you made should be in response to someone who says they need more money rather than less.

Sure. I'm just pointing out that a million bucks isn't that much in the grand scheme. A life-changing amount to just get one day,, sure. But it's still basically "own a house" rich. Woopty-do. Every boomer within 10 miles of a major metro with a paid of mortgage is nearly a millionaire just in their primary residence.

I want Elon Musk to buy Reddit. 😈

Elon: "Now that I've purchased reddit, we're going to rename it x."

Person with an ounce of common sense: "But you already changed twitter's name to that.

Elon: "Don't be stupid. I named it X, whereas reddit is going to be x. It's going to be a totally different brand."

Oh no it would be stupider than that. He would merge Twitter and Reddit as part of his "everything app" which is what he actually wants "X" to be and why he's doing things like trying to turn Twitter into a bank.

Next he will rename himself to XxElon MuskxX

Even Elon Musk can't kill what's already dead.

Elon could be this guy.

This is evil and wild.

Holy shit that would be hilarious!

If he does buy it he'll probably rate limit it like Twitter

This is the way!

No, do jira first pls

Whomp whomp

Yikes Shaggy, it was the old amusement park owner all along.

Reddit has a market cap of $7.8 Billion right now.

Truth Social had a market cap of $8.4 Billion.

Nothing's real 😅😓

Capitalism is literally a pyramid scam.

Why do people keep misrepresenting capitalism as some silly boogie man? This is just as stupid as people claiming socialism is innately bad.

Because most people don't recognize a fundamental difference between capital "C" capitalism (the economic principal of supply and demand. and "venture capitalism" which is about speculating on a business' future based on what essentially amounts to a magic 8 ball.

Because people don’t understand what the word means. They just want upvotes for saying capitalism is bad.

It's all just rigged gambling. That money won't benefit the company at all. The investors just sold all their stocks to the hedge funds and retirement funds for them to lose money on, like always. The IPO was just a way to pay off investors and let executives cash in their stocks. I'd love to know what restrictions on selling came with the stocks that were given to regular employees and users/mods. Like are they allowed to sell right away or do they have to hold it for some period of time?

But about as democratic as can be. No one was forced to buy Reddit. Benefit or not to the company, the company was essentially sold. The new owners of their very own choice will want a return. A big return to essentially cover 8 billion they just paid for it.

Reddit will need tens of billions in revenue to make the profits those new owners will demand. It is that drive to justify the cost that will make it another shitty bloated ad platform.

But that's not really how the stock market works anymore. Now investors don't buy stock to support a company and draw a portion of the profits. That version of the market hasn't existed for a while.

Now, the market is used as a gambling platform for wealthy people and is kept afloat only by IRA, 401k, charitable trusts, etc. Basically, a company is having trouble with profit. You buy into the company, put in a CEO you can control, have them boost the price at the expense of employees, customers, and long-term profit. Sell the stock. Let the company fall apart.

Then buy it low, have the CEO make up a new product based on whatever tech fad is popular. Sell just before the money is spent. Let the project fail because all the money was spent on marketing and consultants and not on the employees to actually do the project. Buy up the stock again, do some stock buybacks, sell again, etc.

But it's never a strategy of: hire really good employees, make them happy, give them an achievable project with enough funding, increase the company's reputation by making quality products, etc. That requires actually good business plans and products and a lot of work and no short term, "hey look at how much money I saved by cutting budgets even though everyone said our products will be crap without it," kinds of flashy quarterly reports.

Playing the gambling game is more reliable profit and with retirement funds and all that keeping serious market crashes from happening, and the politicians being on their side and willing to bail them out if it does get bad, there's a lot of wiggle room and a lot of people to lose money and funnel to them that doesn't affect the corporations.

The stock market has a lot of magical thinking behind it. That's why there are constant frauds.

Influencing Spez's options on steel tarrifs isn't worth as much as the founder of Truth Social

At least truth social is open source

As open source as Reddit? Meaning, original software was but is it currently?

It’s built on mastodon. They got slapped for not linking their source. Not sure if that ever got resolved.

This is the first I've heard of whatever truth social is

It's where all the Maga people went after Twitter started banning them for pushing (I think it was russian) propoganda.

It has 1/100th of the users of Reddit and it's just a Twitter clone but it's meme stocking because Trump is on there. Obviously the company isn't actually worth billions but it's a fun comparison.

It’s a mastodon clone. They literally tried to rip it off and got their hands slapped.

not only is it a mastodon clone, it's an out of date, wretchedly insecure mastodon clone. cause, you know, trump gets the BEST people lol.... fucking clown show

It's still at 50 dollars which is insane. Even 37 dollars is much more than it's worth now, and future looks very bleak for it.

Probably depends on the deal they made for selling our data. Could be a gold mine for em. Here's hoping for a big crash down to earth though.

They sold it to Google for 60 million. That's a hilariously low price.

Why were insiders allowed to sell so quickly?

There's a lot of confused people in these threads. Steve Huffman sold 500,000 shares as part of the ipo, so they were some of the shares sold immediately before they opened on the market (at the about $30/share price). He still holds 4.1 million shares. Other insiders sold some shares as well. Some shares were created to raise money for the company. Once the ipo actually happens and the price for all those shares is negotiated with the bank assisting and all initial buyers, then it begins trading on the open market. At that point they are in a lockup period, and they can't sell anything for about 180 days. All of this is in sec filings, where you can see the source of all the shares that were part ot the ipo.

Look I hate Steve Huffman too, I'm here on lemmy after all. But this is a grossly over valued tech stock and there hasn't been many tech ipos in a while. It's very not surprising it would start sinking after an initial explosion of buying activity. It's not dropping from insiders unloading stock right now though. They're in lockup.

Steve Huffman sold 500,000 shares as part of the ipo, so they were some of the shares sold immediately before they opened on the market (at the about $30/share price).

I suspected as much. I got the invite too, and thought about putting some money in. But I didn't want to risk the chance of being King Steven's exit liquidity, even if I could make some money on it, so I passed.

I wouldn't have wanted to buy anything either. It's actually slightly more progressive than most ipo's in that sense though since it offered a chance to buy shares directly, but that's not really saying much. A true public offering would allow anyone to place orders as a part of the initial sale. Usually just large financial institutions have the chance and then the price is very inflated by the time most retail traders would be allowed to buy. If we really want to help the rampant wealth inequality in the economy too, there should me some mandated equity that goes to employees whose labor built the company so everyone, and not just the board and a few venture capitalists, can profit from the stock sales. Which I guess is a roundabout way of saying workers should own the means of production. It doesn't make sense to reward only so few for the work and ideas of so many individuals. And I think it's a huge inefficiency in the economy that is detrimental no matter your view point (unless you're a billionaire company founder who doesn't care about the country, economy, or world as a whole I guess).

I believe the employees got taken care of here, at least the ones that worked for them directly and stuck it out. Equity compensation is such a key part of Silicon Valley culture that they probably couldn't even hire devs straight out of college without offering them some stock.

I agree, tech companies are better than most in providing equity as a part of compensation, even for lower level workers. I wish it were that way across the entire economy though.

I still believe it was a PPI collection scam. The form I was given to fill out to get on the list was 100% hosted on reddit.com

I was indeed confused and didn't ask that question with any agenda. It makes a lot more sense now. Thanks for clarifying.

Absolutely, and I did not mean to imply you were asking with any agenda, just trying to be helpful. The articles about this are bascially clickbait and implying things that aren't true in the headlines for more outrage. I think it's unfortunate because there is so much to be outraged about in the process of ipo's, how equity in companies is distributed in general, and who profits, and the clickbait distracts from the things we should truly be outraged about with some false controversies.

Oh noooo, who would have guessed the initial week would have been pumped to grift more value out of it and then immediately hard dumped

"Earlier this week, Reddit disclosed in a corporate filing that CEO Steve Hoffman sold 500,000 shares, and Reddit COO Jennifer Wong also disclosed that she sold 514,000 shares."

Third bullet point. Nuff said.

That is definitely part of it, but r/Wallstreetbets is also shorting the fuck out of the stock.

Wow, it doesn't even resemble Reddit anymore. I was also immediately hit with a full page ad. Glad I left.

It somehow looks like a more pic heavy twitter. It's insane how much a site that was built and grew on its comment system seems to try and hide it now.

Because it's bots all the way down

Full page ad? Like a post that takes up the whole page or a legit popup like a mobile game?

A large sponsored video that takes up 90% of the page.

I love that the post about dis-inventing stuff is directly beneath an intrusive ad disguised as a post, a prime example of the kind of thing that should never have been invented.

Gotta get that MIC money, baby!

Digg reference?

They changed it yesterday. It sucks.

I really think most investors really are disconnected from the reality of the companies they are investing in despite there being communities online where you can get the low down. Someone got rich, but it will not be the investors. Suckers.

This was totally expected. Story of most tech IPO’s. It’ll continue to fall into the teens, maybe single digits and stay there for a long time.

Yep, Facebook dropped 50% after the IPO. If you bought at IPO and held on to the stock you now got 10x ROI. Of course FB makes a ridiculous amount of money from ads even at the IPO while Reddit is still struggling.

Super long term investment

I so rarely get to do my c/news duty outside of that community, and you're welcome.

That spezial mod of r/jailbait already cashed out his shares for something like 16 million so he got his... I doubt he cares what happens now.

Stock Market Capitalism is just imaginary numbers made up by rich people to convince other rich people to give them money. It's completely ephemeral.

The fact that it can rise or fall with nothing more than a silly antic from one person is proof about how insubstantial and frankly ridiculous the whole scheme is.

Well I mean money has been arbitrary since it was invented. Why is one shiny metal more desirable than another shiny metal? Because it's yellow. Rarity didn't even always factor into it; centuries ago the Spanish tearing up South America looking for gold dumped enormous amounts of platinum into the ocean because nobody "knew" it was valuable. Because it was the wrong color but not actual silver.

Fun fact: the capstone on the Washington Monument is a nine-inch tall piece of aluminum. It was expensive because it was difficult to refine until the Bayer process was developed two years after it was set.

Stock price is really just a present value of future expected earnings. Buying Coke for $100 is because you think the earnings of that share in the future is worth $100. So yes, if the company makes an announcement that it isn't as profitable, the price will go down, because buyers won't want to pay the same for an asset that is returns less than it was expedited to.

Yes, there are complications. Shorts, futures, non dividend yielding shares, and more make it more muddied. At the end of it though, the future expected earnings are what is being bought and sold.

Hold on guys. I want to sell you all together for a lot of money. I mean not you personally just everything you write. No worries 😁.

What are our rights with posts on lemmy? Can AI companies just scrape the data?

If it is publicly accessible, then yes, they scrape the data.

This is literally how search engines have worked since damn near the inception of the internet.

Wasn't there robots.txt at least?

Robots.txt is a compliance standard afaik, more like an advisory guide. It cannot enforce bans on scrapers, it sets some polite boundaries for the website.

There was, and still is

They can, and they do.

Called it. Overvalued. The site has been is in dire need of investments to improve the platform. Give tools for the moderators to do their job properly (they're already working for free), improve the page layout, fight bots in a more intelligent manner, find innovative ways to make the platform turn a profit instead of resorting to the most assholeish, intrusive and abusive ways ever. But instead the dipshit that runs that dumpster fire gave himself a huge undeserved paycheck with the money that should have been used to do that so when it inevitably comes crashing down he has made some reserves.

I wouldn't be surprised if most of the traffic on that site is bots farming karma so they can spam some ads at that point and a significant portion of human accounts they have left are probably shadow banned by false bot detection. Every attempt they've made to make money out of the platform was so terribly thought through that it just unnecessarily resulted in a far worse experience for the userbase than it needed to, screwed over the people who work for free to keep running and was met with huge backlash every time. And they still can't turn a profit.

Bull trap. Which will follow with a bear trap. Then after two bounces it'll crash like Robinhood.

I'll stick to VTI and VXUS.

Ya love to see it folks.

Hey there, it's been a while, hope you are doing well

This reminds me of the things preceding the 1929 stock market crash. I'm not a history expert and know very little about it, but I recall that just before it happened, many people who ordinarily did not care about the stock market or had to means to care about suddenly started speculating in the market. That may not have lead to the crash but possibly it was a symptom of whatever has fuckening. I think just looking at us all here talking about how reddit this and that blah blah, that's a symptom of the impending market crash of the early 20's. LOL it would be hilarious if it happened exactly in 2029.

Elle oh Elle 😂

Let me know when it becomes a penny stock...

F

U

C

K

S

P

E

Z

F

Ooh nooooooo... anyway.

I'm doing my part!

Ya love to see it

Why do we keep seeing these fake news headlines? It's up 40% since IPO.

It's not a fake news headline - the stock closed below the first day close price, not the IPO price.

I mean, yeah? Happens with most IPO's after all and as long as it stays stable and higher than the 34 initial IPO price, I'll be a happy camper.

You invested in reddit?

Yes. I had the chance to buy into the IPO with my old, dead account so I had some extra cash that I could invest/gamble with so I pickup a few shares and I put in a reminder to sell at the end of the lock out phase.

I mean you can hate reddit all you want, I'm not active on the site myself outside of a few niche communities that don't have active home here but I personally don't have qualms about making some money off of reddit if I can.

How long is the lockout period?

Piggy boy etc have a 180 day lock.

What about the incentive investors? The Reddit members that got the early invitation?

No idea

It's honestly more that investing in a company that hasn't been profitable for 20 years and has had the CEO admit they don't know how to properly turn a profit doesn't strike me as a good investment.

I'm not saying you should get out, your money is your business of course but you may want to look at how other IPOs performed immediately after release. The ones I know of are CRSR(CORSAIR GAMING), OLPX(OLAPLEX), and RR(RICHTECH ROBOTICS). All three of these spiked dramatically up after the initial offering, then crashed to less than half the price of the initial offering ( except CRSR which is at offering price currently).

Now these aren't the same industries of course so things could differ but I would be surprised if it did. The selling of data for LLMs(AI) is very limited IMO mainly because the more AI generated content reddit has the worst the model will be for the LLMs and AI content is pretty high right now. RDDT just does not have good fundamentals for an investment, public sentiment is super low already and now viable alternatives are popping up like lemmy. I am also sure that now they are public reddit will only get shittier for the user leading to a lost base.

I am not a financial advisor, this is just my opinion. I would personally get out relatively soon after you capture some profits and not look back. Again I'm not trying to tell you what to do but I would strongly consider these things. Best of luck and I hope you get some nice gains from it!

So for me I have no faith in the company, I'm just making a bet with some extra money, and again it's just my fun money to see if my theory that wall street is freaking insane and just still just chases after tech.

There's no expectation that this will pay out big, if at all, and losing this little bit of cash won't break me.

"Earlier this week, Reddit disclosed in a corporate filing that CEO Steve Hoffman sold 500,000 shares, and Reddit COO Jennifer Wong also disclosed that she sold 514,000 shares."

If they believed in the platform, they would hold. Yeah looks like they are looking for bag holders.

I think it matters more what percent of their holdings they sell rather than the amount they sell.

The COO holds 1.4 million now, so she dumped 25% of her shares

To be fair (and you can probably see by my username I don’t like reddit anymore), I think it makes perfect sense to dispose of a fair portion of your shares in this situation. Firstly, these asshats get paid part of their salary in shares, it’s natural to want to get more security on part of your income. Secondly, with how hard the price rose in the first couple of days, it makes sense. But people are welcome to disagree, of course.

How does that respond to the original idea, that is:

if they believed in the company, they would hold their stock.

You are not a genius for selling your company's stock after IPO, you are a grifter. Doesn't matter how many voting shares they have, doesn't matter how much more money they need - they do get paid in cash too, and they can borrow against the stock.

So they sold out. Fuck them both for that.

Selling quarter of your stock AT THE FUCKING IPO is a shame. I can't believe people are defending that.

And I suspect they can't sell the rest as easily as the A shares.

That's SOP for tech companies.

And how does that go against the "they don't have faith in their business" argument?

Imagine talking about faith in that situation. If you really think faith is a good base for financial decisions you better keep far away from the stock market.

I have nothing I'm willing to defend about Reddit management, I love the idea that they will end up penniless one day (though I'm sure that will not happen.)

I just don't think selling off 25% of one's shares (necessarily) means what has been suggested.

What would you agree means that they don't have faith in their business?

Selling everything = I have no faith

Keeping everything when these shares represent almost your entire net worth = I know with 100% certainty that this business will grow

Selling off 25% = I believe in the company, but I also acknowledge that there are many variables outside of my control that can affect the success of this company and I don't want those to have huge negative repercussions on my life.

The point would be to diversify assets. You don't want to gamble everything on the hope the thing you believe in is successful. Not that I think they believe in the platform, but it is probably a smart idea to diversify no matter what. 25% of your shares does seem like a lot though.

If they sold at $50 a share, they pocketed over $25M each. Even after taxes, that is more than enough to live comfortably in any region's cost of living.

That's not diversifying. That is greed.

Them not selling isn't any more greedy. No matter what, they own the value of the stocks, whether they liquidate them or not. It's fucked up that anyone gets paid that amount in general, but they did and it's theirs. I don't know what you people would want from them. Isn't holding onto the shares hoping the value goes up even more greedy?

They get paid in cash ffs.

You sell stock when you think it's overvalued.

Or you sell stock when you need to rebalance. Fuck spez, but selling 25% at IPO seems sane and reasonable to me.

I don't know how much of a bag holding exercise it is instead of a "treat yoself" moment. Half a million shares at $50/share is $25 mil, minus 50% taxes is $12.5 mil.

That isn't that much money in the bay area. Don't get me wrong. It's a lot. But that's just a $4 million house with another $1 million in furnishings, and I'm guessing a nice car or two. Take the other $6 mil and invest in a diverse portfolio. They've basically sold their stock so they can square away their personal lives.

Won't somebody think of the poor shareholders.

When I treat myself, it's to a takeaway meal that's like $20. Reddit has "never made a profit"™. Siphoning $16mil out of it on day one is obscene.

In what way do you think they've siphoned $16mm out of Reddit?

Awarded themselves shitloads of stock, then sold a quarter of their shares each as soon as humanly possible. That money is not being invested in the company, it's going straight in these individual's pockets.

I wasn't trying to make a "won't someone think about the shareholders" argument. Thanks for the strawman.

Really the gist of what I was after is "you'd do the same in their position". $12.5 mil is a lot, but we're not talking about $12.5mil/year. Its a one time sale. Someone that earns $100,000/yr just saw 125 years of income materialize in a couple seconds. But if you had the same opportunity, you'd probably do the same. If you would instead donate it to charity, please let us know which charities you'd donate to.

Fair enough, you didn't say you condone it. But your comment does read with much more support than I would offer. And asking me which charities I'd donate to... ha! I don't see why that's relevant. Maybe I would do the same, but I don't already have an $800,000/yr base salary.

More relevant: this windfall would be 250yrs income for me. And on that income I already do donate to charity (albeit probably about 2% of my earnings). If this chump followed my percentage they would be donating 6 whole years worth of my salary on this windfall (plus 1/3 of my salary per year).

The point is "treating yoself" to $12mil after tax is absolutely obscene whatever way you look at it. Not to mention still sitting on 3x more than that.

That's not how stocks work. Share value doesn't go to the company unless the company sells shares of itself that it owns. It also doesn't lose money from share value unless it buys shares. The value of shares goes to the shareholder when sold, and it comes out of the wallet of the buyer.

It's a show of a lack of faith maybe, but it doesn't effect the company at all except for the effect on stock value from selling if the company also decides to liquidate shares too.

Share prices don't only fall if the company liquidated stock. They will also fall from something like a mass sell-off because lower and lower prices will be commanded to sell large volumes of stock.

You know, like the one in the article that talks about the 25% drop in share value.

Yeah, I mentioned selling dropping the price, but the price doesn't effect the company except for the stocks the company itself sells. Having an extremely high or low stock value doesn't matter if the company isn't selling stocks. It's only an indication that the company is doing well or poorly.

We all knew this was a pump and dump scheme. Spez got his, fuck everyone else.

did he really though? because I'd read a big chunk of that massive 100+ million dollar compensation was shares vested after IPO based on performance.

hopefully it ruins them all.

He sold 500 000 shares for a big fat paycheck. It's not 100 millions of fictional dollars, but he still made out like a bandit.

I'm not so sure. That is only $25 million or so. Who can live on that?

Yeah, this guy isn't even going to be able to afford caviar for dinner every night. That's not living.

$25 million will allow you to, at best, snort cocaine off a hooker’s forearm. Not doing it off her ass is like seeing a partial eclipse.

Me. I can live on that. I would have to change my habits like eating more but that’s something I am willing to change.

Lobster and sushi only on days that end with a Y. It'll be tough cutting back but he'll manage.

I bet i could live even off 24 Million, call me crazy

I'd have to live like a hobo tho

I could live comfortably for the rest of my life on 1/25th of that.

Or you could buy a house within a reasonable distance of a major city.

The statement you made should be in response to someone who says they need more money rather than less.

Sure. I'm just pointing out that a million bucks isn't that much in the grand scheme. A life-changing amount to just get one day,, sure. But it's still basically "own a house" rich. Woopty-do. Every boomer within 10 miles of a major metro with a paid of mortgage is nearly a millionaire just in their primary residence.

I want Elon Musk to buy Reddit. 😈

Elon: "Now that I've purchased reddit, we're going to rename it x."

Person with an ounce of common sense: "But you already changed twitter's name to that.

Elon: "Don't be stupid. I named it X, whereas reddit is going to be x. It's going to be a totally different brand."

Oh no it would be stupider than that. He would merge Twitter and Reddit as part of his "everything app" which is what he actually wants "X" to be and why he's doing things like trying to turn Twitter into a bank.

Next he will rename himself to XxElon MuskxX

Even Elon Musk can't kill what's already dead.

Elon could be this guy.

This is evil and wild.

Holy shit that would be hilarious!

If he does buy it he'll probably rate limit it like Twitter

This is the way!

No, do jira first pls

Whomp whomp

Yikes Shaggy, it was the old amusement park owner all along.

Ellen Pao is long gone, though.

Reddit has a market cap of $7.8 Billion right now.

Truth Social had a market cap of $8.4 Billion.

Nothing's real 😅😓

Capitalism is literally a pyramid scam.

Why do people keep misrepresenting capitalism as some silly boogie man? This is just as stupid as people claiming socialism is innately bad.

Because most people don't recognize a fundamental difference between capital "C" capitalism (the economic principal of supply and demand. and "venture capitalism" which is about speculating on a business' future based on what essentially amounts to a magic 8 ball.

Because people don’t understand what the word means. They just want upvotes for saying capitalism is bad.

It's all just rigged gambling. That money won't benefit the company at all. The investors just sold all their stocks to the hedge funds and retirement funds for them to lose money on, like always. The IPO was just a way to pay off investors and let executives cash in their stocks. I'd love to know what restrictions on selling came with the stocks that were given to regular employees and users/mods. Like are they allowed to sell right away or do they have to hold it for some period of time?

But about as democratic as can be. No one was forced to buy Reddit. Benefit or not to the company, the company was essentially sold. The new owners of their very own choice will want a return. A big return to essentially cover 8 billion they just paid for it.

Reddit will need tens of billions in revenue to make the profits those new owners will demand. It is that drive to justify the cost that will make it another shitty bloated ad platform.

But that's not really how the stock market works anymore. Now investors don't buy stock to support a company and draw a portion of the profits. That version of the market hasn't existed for a while.

Now, the market is used as a gambling platform for wealthy people and is kept afloat only by IRA, 401k, charitable trusts, etc. Basically, a company is having trouble with profit. You buy into the company, put in a CEO you can control, have them boost the price at the expense of employees, customers, and long-term profit. Sell the stock. Let the company fall apart.

Then buy it low, have the CEO make up a new product based on whatever tech fad is popular. Sell just before the money is spent. Let the project fail because all the money was spent on marketing and consultants and not on the employees to actually do the project. Buy up the stock again, do some stock buybacks, sell again, etc.

But it's never a strategy of: hire really good employees, make them happy, give them an achievable project with enough funding, increase the company's reputation by making quality products, etc. That requires actually good business plans and products and a lot of work and no short term, "hey look at how much money I saved by cutting budgets even though everyone said our products will be crap without it," kinds of flashy quarterly reports.

Playing the gambling game is more reliable profit and with retirement funds and all that keeping serious market crashes from happening, and the politicians being on their side and willing to bail them out if it does get bad, there's a lot of wiggle room and a lot of people to lose money and funnel to them that doesn't affect the corporations.

The stock market has a lot of magical thinking behind it. That's why there are constant frauds.

Influencing Spez's options on steel tarrifs isn't worth as much as the founder of Truth Social

At least truth social is open source

As open source as Reddit? Meaning, original software was but is it currently?

It’s built on mastodon. They got slapped for not linking their source. Not sure if that ever got resolved.

This is the first I've heard of whatever truth social is

It's where all the Maga people went after Twitter started banning them for pushing (I think it was russian) propoganda.

It has 1/100th of the users of Reddit and it's just a Twitter clone but it's meme stocking because Trump is on there. Obviously the company isn't actually worth billions but it's a fun comparison.

It’s a mastodon clone. They literally tried to rip it off and got their hands slapped.

not only is it a mastodon clone, it's an out of date, wretchedly insecure mastodon clone. cause, you know, trump gets the BEST people lol.... fucking clown show

It's still at 50 dollars which is insane. Even 37 dollars is much more than it's worth now, and future looks very bleak for it.

Probably depends on the deal they made for selling our data. Could be a gold mine for em. Here's hoping for a big crash down to earth though.

They sold it to Google for 60 million. That's a hilariously low price.

Why were insiders allowed to sell so quickly?

There's a lot of confused people in these threads. Steve Huffman sold 500,000 shares as part of the ipo, so they were some of the shares sold immediately before they opened on the market (at the about $30/share price). He still holds 4.1 million shares. Other insiders sold some shares as well. Some shares were created to raise money for the company. Once the ipo actually happens and the price for all those shares is negotiated with the bank assisting and all initial buyers, then it begins trading on the open market. At that point they are in a lockup period, and they can't sell anything for about 180 days. All of this is in sec filings, where you can see the source of all the shares that were part ot the ipo.

Look I hate Steve Huffman too, I'm here on lemmy after all. But this is a grossly over valued tech stock and there hasn't been many tech ipos in a while. It's very not surprising it would start sinking after an initial explosion of buying activity. It's not dropping from insiders unloading stock right now though. They're in lockup.

I suspected as much. I got the invite too, and thought about putting some money in. But I didn't want to risk the chance of being King Steven's exit liquidity, even if I could make some money on it, so I passed.

I wouldn't have wanted to buy anything either. It's actually slightly more progressive than most ipo's in that sense though since it offered a chance to buy shares directly, but that's not really saying much. A true public offering would allow anyone to place orders as a part of the initial sale. Usually just large financial institutions have the chance and then the price is very inflated by the time most retail traders would be allowed to buy. If we really want to help the rampant wealth inequality in the economy too, there should me some mandated equity that goes to employees whose labor built the company so everyone, and not just the board and a few venture capitalists, can profit from the stock sales. Which I guess is a roundabout way of saying workers should own the means of production. It doesn't make sense to reward only so few for the work and ideas of so many individuals. And I think it's a huge inefficiency in the economy that is detrimental no matter your view point (unless you're a billionaire company founder who doesn't care about the country, economy, or world as a whole I guess).

I believe the employees got taken care of here, at least the ones that worked for them directly and stuck it out. Equity compensation is such a key part of Silicon Valley culture that they probably couldn't even hire devs straight out of college without offering them some stock.

I agree, tech companies are better than most in providing equity as a part of compensation, even for lower level workers. I wish it were that way across the entire economy though.

I still believe it was a PPI collection scam. The form I was given to fill out to get on the list was 100% hosted on reddit.com

I was indeed confused and didn't ask that question with any agenda. It makes a lot more sense now. Thanks for clarifying.

Absolutely, and I did not mean to imply you were asking with any agenda, just trying to be helpful. The articles about this are bascially clickbait and implying things that aren't true in the headlines for more outrage. I think it's unfortunate because there is so much to be outraged about in the process of ipo's, how equity in companies is distributed in general, and who profits, and the clickbait distracts from the things we should truly be outraged about with some false controversies.

Oh noooo, who would have guessed the initial week would have been pumped to grift more value out of it and then immediately hard dumped

"Earlier this week, Reddit disclosed in a corporate filing that CEO Steve Hoffman sold 500,000 shares, and Reddit COO Jennifer Wong also disclosed that she sold 514,000 shares."

Third bullet point. Nuff said.

That is definitely part of it, but r/Wallstreetbets is also shorting the fuck out of the stock.

One of multiple threads- https://www.reddit.com/r/wallstreetbets/comments/1bcfl86/reasons_to_short_the_reddit_ipo_make_big/

Oh I forgot about those guys. Juicy.

Tally ho lads

This is normal and not a big deal at all. Essentially happens with most IPOs.

This is generally how IPOs work out. Same happened with ARM.

Yup. Nothing surprising.

Let me show you this tiny violin 🎻

Now that is a tiny violin.

It's bigger than the emoji though.

That's true. Violin science is complicated, man...

Looks like a tiny cello to me

GOD I LOVE THIS.

thoughts and prayers; go bears.

Hope it keeps plummeting.

The layout change this week is what did them in.

Wow, it doesn't even resemble Reddit anymore. I was also immediately hit with a full page ad. Glad I left.

It somehow looks like a more pic heavy twitter. It's insane how much a site that was built and grew on its comment system seems to try and hide it now.

Because it's bots all the way down

Full page ad? Like a post that takes up the whole page or a legit popup like a mobile game?

A large sponsored video that takes up 90% of the page.

I love that the post about dis-inventing stuff is directly beneath an intrusive ad disguised as a post, a prime example of the kind of thing that should never have been invented.

Gotta get that MIC money, baby!

Digg reference?

They changed it yesterday. It sucks.

I really think most investors really are disconnected from the reality of the companies they are investing in despite there being communities online where you can get the low down. Someone got rich, but it will not be the investors. Suckers.

This was totally expected. Story of most tech IPO’s. It’ll continue to fall into the teens, maybe single digits and stay there for a long time.

Yep, Facebook dropped 50% after the IPO. If you bought at IPO and held on to the stock you now got 10x ROI. Of course FB makes a ridiculous amount of money from ads even at the IPO while Reddit is still struggling.

Super long term investment

I so rarely get to do my c/news duty outside of that community, and you're welcome.

That spezial mod of r/jailbait already cashed out his shares for something like 16 million so he got his... I doubt he cares what happens now.

Stock Market Capitalism is just imaginary numbers made up by rich people to convince other rich people to give them money. It's completely ephemeral.

The fact that it can rise or fall with nothing more than a silly antic from one person is proof about how insubstantial and frankly ridiculous the whole scheme is.

Well I mean money has been arbitrary since it was invented. Why is one shiny metal more desirable than another shiny metal? Because it's yellow. Rarity didn't even always factor into it; centuries ago the Spanish tearing up South America looking for gold dumped enormous amounts of platinum into the ocean because nobody "knew" it was valuable. Because it was the wrong color but not actual silver.

Fun fact: the capstone on the Washington Monument is a nine-inch tall piece of aluminum. It was expensive because it was difficult to refine until the Bayer process was developed two years after it was set.

Stock price is really just a present value of future expected earnings. Buying Coke for $100 is because you think the earnings of that share in the future is worth $100. So yes, if the company makes an announcement that it isn't as profitable, the price will go down, because buyers won't want to pay the same for an asset that is returns less than it was expedited to.

Yes, there are complications. Shorts, futures, non dividend yielding shares, and more make it more muddied. At the end of it though, the future expected earnings are what is being bought and sold.

Hold on guys. I want to sell you all together for a lot of money. I mean not you personally just everything you write. No worries 😁.

What are our rights with posts on lemmy? Can AI companies just scrape the data?

If it is publicly accessible, then yes, they scrape the data.

This is literally how search engines have worked since damn near the inception of the internet.

Wasn't there robots.txt at least?

Robots.txt is a compliance standard afaik, more like an advisory guide. It cannot enforce bans on scrapers, it sets some polite boundaries for the website.

There was, and still is

They can, and they do.

Called it. Overvalued. The site has been is in dire need of investments to improve the platform. Give tools for the moderators to do their job properly (they're already working for free), improve the page layout, fight bots in a more intelligent manner, find innovative ways to make the platform turn a profit instead of resorting to the most assholeish, intrusive and abusive ways ever. But instead the dipshit that runs that dumpster fire gave himself a huge undeserved paycheck with the money that should have been used to do that so when it inevitably comes crashing down he has made some reserves.

I wouldn't be surprised if most of the traffic on that site is bots farming karma so they can spam some ads at that point and a significant portion of human accounts they have left are probably shadow banned by false bot detection. Every attempt they've made to make money out of the platform was so terribly thought through that it just unnecessarily resulted in a far worse experience for the userbase than it needed to, screwed over the people who work for free to keep running and was met with huge backlash every time. And they still can't turn a profit.

Bull trap. Which will follow with a bear trap. Then after two bounces it'll crash like Robinhood.

I'll stick to VTI and VXUS.

Ya love to see it folks.

Hey there, it's been a while, hope you are doing well

This reminds me of the things preceding the 1929 stock market crash. I'm not a history expert and know very little about it, but I recall that just before it happened, many people who ordinarily did not care about the stock market or had to means to care about suddenly started speculating in the market. That may not have lead to the crash but possibly it was a symptom of whatever has fuckening. I think just looking at us all here talking about how reddit this and that blah blah, that's a symptom of the impending market crash of the early 20's. LOL it would be hilarious if it happened exactly in 2029.

Elle oh Elle 😂

Let me know when it becomes a penny stock...

F

U

C

K

S

P

E

Z

F

Ooh nooooooo... anyway.

I'm doing my part!

Ya love to see it

Why do we keep seeing these fake news headlines? It's up 40% since IPO.

It's not a fake news headline - the stock closed below the first day close price, not the IPO price.

I mean, yeah? Happens with most IPO's after all and as long as it stays stable and higher than the 34 initial IPO price, I'll be a happy camper.

You invested in reddit?

Yes. I had the chance to buy into the IPO with my old, dead account so I had some extra cash that I could invest/gamble with so I pickup a few shares and I put in a reminder to sell at the end of the lock out phase.

I mean you can hate reddit all you want, I'm not active on the site myself outside of a few niche communities that don't have active home here but I personally don't have qualms about making some money off of reddit if I can.

How long is the lockout period?

Piggy boy etc have a 180 day lock.

What about the incentive investors? The Reddit members that got the early invitation?

No idea

It's honestly more that investing in a company that hasn't been profitable for 20 years and has had the CEO admit they don't know how to properly turn a profit doesn't strike me as a good investment.

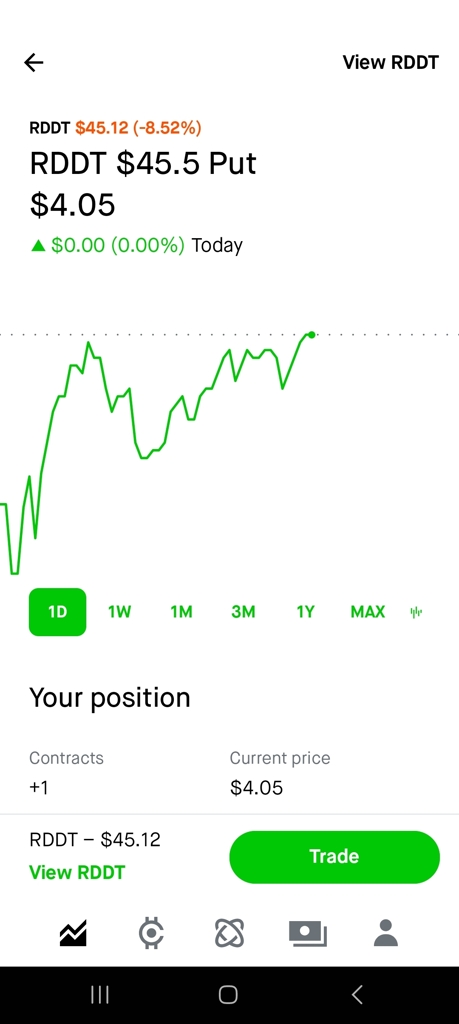

I'm not saying you should get out, your money is your business of course but you may want to look at how other IPOs performed immediately after release. The ones I know of are CRSR(CORSAIR GAMING), OLPX(OLAPLEX), and RR(RICHTECH ROBOTICS). All three of these spiked dramatically up after the initial offering, then crashed to less than half the price of the initial offering ( except CRSR which is at offering price currently).

Now these aren't the same industries of course so things could differ but I would be surprised if it did. The selling of data for LLMs(AI) is very limited IMO mainly because the more AI generated content reddit has the worst the model will be for the LLMs and AI content is pretty high right now. RDDT just does not have good fundamentals for an investment, public sentiment is super low already and now viable alternatives are popping up like lemmy. I am also sure that now they are public reddit will only get shittier for the user leading to a lost base.

I am not a financial advisor, this is just my opinion. I would personally get out relatively soon after you capture some profits and not look back. Again I'm not trying to tell you what to do but I would strongly consider these things. Best of luck and I hope you get some nice gains from it!

So for me I have no faith in the company, I'm just making a bet with some extra money, and again it's just my fun money to see if my theory that wall street is freaking insane and just still just chases after tech.

There's no expectation that this will pay out big, if at all, and losing this little bit of cash won't break me.